Using Option Collars to Diversify Concentrated RSU Positions in a Tax-Efficient Way

How can I diversify out of concentrated positions in a tax-efficient way?

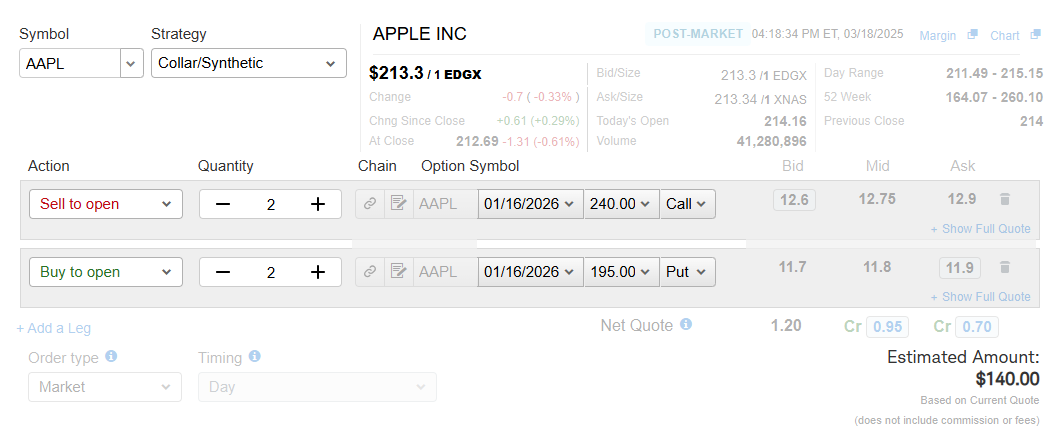

➡️ One option (quite literally) is by utilizing an “option collar”, as exemplified below using AAPL.

Let's assume that you have significant AAPL shares from when you were a former* employee and received RSUs (restricted stock units). The shares have now appreciated in value and represent a significant percentage of your total net worth. In other words, you have "concentration risk" and need to find a way to diversify your holdings in a tax-efficient way. Although you don’t want to risk a substantial decline in value, you also don’t really want to sell your position and recognize the capital gains this year either (because it’s a high-income year for you).

*the reason why I’m specifically calling out former employees is because if you’re currently employed by the same company, you are forbidden from hedging on the public market.

What to do?

One possibility: you can "collar" your shares until January of next year. In doing so:

1️⃣ You cap your upside potential. In this example, above, you’ll "sell a call" at $240/share. What this means is that if Apple shares appreciate beyond $240 by January 16, 2026 (~10%+ higher than they are priced today), you'll be required to sell those shares for $240 — even if they are trading at a much higher price. But, in exchange for capping your upside potential, you will be compensated in the amount of ~$1,275.

2️⃣ You limit your downside risk. Also in the example, above, you’ll "buy a put" at $195/share. What this means is that if Apple shares fall below $195 (~8.5% lower than they are priced today), you'll still be able to sell them for $195/share. This is essentially the equivalent of buying an insurance policy on your Apple shares. And, in exchange for having this “insurance” if Apple shares decline, you’ll have to pay $1,180

Net-net: you sell your right to generate excess upside (above $240/share) and you buy a right to sell at a minimum price (at least $195/share). The net impact is +$1,275 - $1,180 = +$95 in your pocket.

Typically, the goal of collaring shares isn’t to profit on the collar itself (the $95). But in this particular example it doesn’t hurt that you’re paid more to execute this strategy than it costs you to purchase (this also tells you where the market is placing it’s bets).

Overall, this is a strategy that my clients and I sometimes employer when they are former employees and have highly appreciated and concentrated stock positions.

**This post is for informational purposes only and should not be considered investment advice. Seek a professional for any personalized guidance**