Why do I charge a flat fee?

One of the most common fee structures in the financial services industry is to bill based on a “percentage of assets under management”.

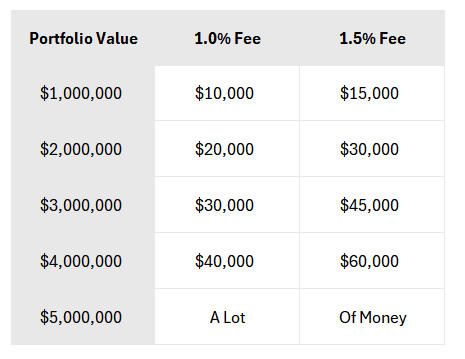

Typically, that fee structure ranges from 1.0% - 1.5% of Assets Under Management (AUM) – and paired with an asset minimum of ~$1,000,000. And, that’s just for investment management – no tax planning, no equity compensation analyses, no Monte Carlo simulations, no rent vs. buy analyses, no estate planning considerations, etc.

Here’s what a typical “percentage of AUM” fee structure looks like in graphical, dollar terms:

The rationale that you’ll hear for this model from advisors is that “billing as a % of AUM aligns incentives because the advisor does better (i.e. makes more money) when you do better (i.e. your portfolio grows)”. Personally, I don’t buy it and I actually think that AUM-based billing leads to more conflicts of interest than aligned incentives, which I’ll explain below.

Note: the reason for the $1M portfolio minimum is that advisors don’t want to deal with (presumably unprofitable) clients who only generate $1,000 in revenue by virtue of having a $100,000 portfolio size (1% of $100,000 = $1,000), but who still require the same amount of effort and attention as more profitable clients.

I have deliberately structured my business away from this archaic pricing model, and instead I charge a flat rate for every. single. one. of my clients.

Here are the reasons why:

Flat fees are stupidly simple and transparent. The financial services industry is complicated and often opaque. Personally, I don’t like the feeling of not understanding something. And I tend to believe that my clients feel the same way. I want my clients to know exactly what they’re paying – in dollars. Whether intentional or not, an AUM-based fee structure can turn out to be quite deceptive. “We only charge 1%” seems innocuous enough until you realize what that translates to in dollar terms (see chart above).

Complexity doesn’t scale with portfolio size. Allison has a $1M portfolio, all in taxable accounts. Bob has a $3M portfolio, all in taxable accounts. All else equal, is Bob’s situation 3x as complicated as that of Allison? Will Bob require 3x the time and attention as Allison? Unlikely.

In fact, the inverse is often true: Charlie has a $1M portfolio across various tax-deferred, tax-free, and taxable accounts. Charlie also has private company equity (ISOs, NSOs, RSUs) that technically doesn’t count towards “assets under management” but nevertheless requires substantial tax planning and consideration. David, on the other hand, has a $4M portfolio – all in taxable accounts. Whose situation is more complex? Whose situation will take more of the advisor’s time? Probably Charlie’s. But who ends up paying a higher fee? David.

In my view, AUM actually increases conflicts of interest. Let’s assume that you’re looking to buy your dream house and you’ll need to put $500,000 down to purchase it. In theory, your AUM-based advisor should be super pumped for you (congrats!!) and encourage you to put the money down (assuming that it makes financial sense and is the right decision for you). But with a 1% fee, once you put that money down, your advisor just took a 1% x $500,000 = $5,000 annual pay cut. Do you think that factored into their suggestion? Hopefully not, but money talks and humans are motivated by incentives. Full stop.

Or, imagine that you just left your job and have a $200,000 401k account balance. Sometimes it makes sense to roll that balance into an IRA under your advisor’s management. But sometimes it could make more strategic sense to keep the 401k as is or roll it into a new 401k plan. So when your advisor recommends that you roll the $200,000 into an IRA under their advisership…is that because they want a quick $2,000 (1% of $200,000) revenue bump? Or is it because that’s truly the right thing to do?

You don’t need to be paying for fancy offices or TV commercials. AUM fees do more than just pay for your advisor's services. They pay for luxury downtown office space, TV commercials, marketing campaigns, and various middle manager salaries, etc. I’m not here to say that that is necessarily a bad thing – but what if, in modern 2025, we could cut out those expenses and serve clients at a fraction of the cost? I work from home (no office space with “Presidio Advisors” sprawled across the top). You won’t see me shelling out for a Super Bowl commercial (although, damn, that would cool). I deliberately have no employees because I have no intention of scaling (a topic of another blog post). My costs are lower than most. And, as a result, I can generally serve clients profitably at a lower price point.

So what’s in it for me as the advisor? Wouldn’t I rather have some clients paying me more?

Actually, no. Here’s why:

I sleep really well at night. I never feel like I’m overcharging clients. My clients aren’t paying me for asset management (although this is included in my fee structure). Rather, they are paying me a retainer for advice on life goals. They are paying me to act as their de facto “personal CFO” and to help them answer the question “how do I use my wealth to live my best life?” They are definitively not hiring me to help them answer the question of “how do I accumulate the most amount of assets?”

I never have to worry about being “addicted” to any one particular client. Let’s take an extreme example of a client with $80,000,000 of assets under my management who pays me 1% ($800,000 annually). And then let’s assume that all of my other clients have substantially fewer assets so they pay substantially less (but still a reasonable amount). Can you imagine how stressed I would be that this single mega-client would leave me and then my $800,000 of income would *poof* evaporate overnight? Another downside for me (and my other clients): how much time in my day do you think would be allocated towards serving this one client vs. serving all of my other clients? I started this business to build relationships with 40-50 client households – not to start a “family office” that is dedicated to one individual.

Each of my clients is “Tier 1” to me. When every client pays me the same amount, every client is equally important to me. That, in my view, leads to better service for all. I value each of you the same. With an AUM model, clients are necessarily categorized by revenue/profitability. That means that your level of assets dictates your service level. Many of my clients have transferred from some of the big-name wealth management firms. These clients often complained that their prior advisors took eons to respond to email requests, were often rotating in and out of the big-name firm, and they felt like they were low (wo)man on the totem pole. Why did they feel that way? It’s because even with a $1M portfolio, they were precisely that low on the priority list. They were inevitably Tier 4 clients.

The downside for me is that I limit my ability to scale and grow – but that’s ok. The downside with a flat fee, of course, is that I probably cap my upside. I’ll get paid less over time and my business model won’t scale (that is, it’s harder to hire other employees/advisors or take on additional clients). I don’t have super wealthy clients subsidizing lower profitability clients. And that is probably the biggest reason why you don’t often see this fee model across the industry. Guess what – I’m not here to make a bazillion dollars and I have no intention of building up a large firm with numerous advisors, middle managers, or other office employees. I built this business to be a lifestyle business – so that I can spend more time with my own family while still developing deep relationships with 40-50 clients. After all, it’s those relationships that get me up in the morning. I truly believe that I cannot serve more than 40-50 clients without compromising my desire to provide white glove, highly personalized services.