What is your time worth?

One of the best moves that high-income Millennials can make is to outsource the things that drain their headspace or cause stress.

Here are a few things I gladly pay a premium for, even though I *could* do them myself:

1. House cleaners 2x/month (insane ROI for our marriage)

2. Oil changes at the dealership

3. Walmart+ grocery delivery (not a sponsored post)

4. Some yard work (yes, I still mow)

Vanguard just published an interesting study showing that 76% of advised clients say financial advice saves them a median of two hours per week.

That’s more than 100 hours per year just from not thinking about or dealing with their finances.

And that’s before you even factor in:

- Big equity comp/liquidity event decisioning

- Investment/emotional mistakes prevented

- Tax-optimization strategies

- Having a thought partner for big decisions such as buying a house

- Having an accountability partner to ensure you get sh*t done

- Identifying blind spots (estate planning, concentration risk, etc.) within your plan

- Gaining clarity around the next 5+ years of cashflows

- Giving you confidence that you can take a sabbatical and still retire "on time"

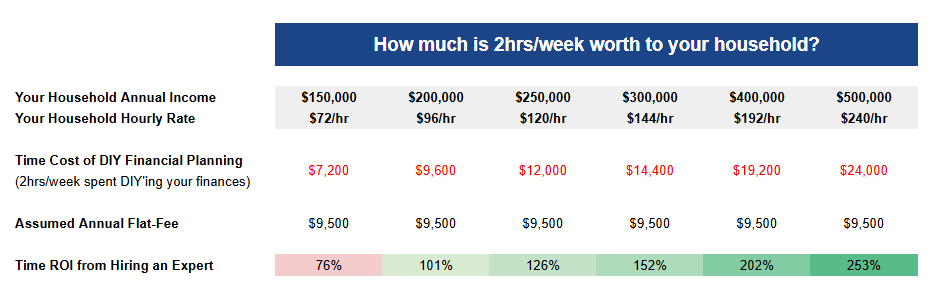

So let’s run with it: say that you gain 2 hours a week back in your life and nothing more.

How are you now spending that time with your family, friends? And, how much is that worth to you? Take a look at your "household hourly rate", below.

➡️ Hiring a fiduciary who truly understands your life goals, risk tolerance/capacity, and ‘what keeps you up at night’ isn’t cheap. But neither is your time or the opportunity cost of how you spend it.

Values calculated in annual costs assuming 100hrs annually (2hrs/week) spent DIY’ing your finances